Public Sector Survey Results

Public sector guidelines are under the spotlight again for the fourth year running. The most recent developments – pencilled in to be applied from April 2017 – which puts the engager (or agency) in control of the contractors’ IR35 future – are clearly cause for concern and not just for public sector contractors, but possibly for all private sector contractors too (as suggested in the IR35 consultation last year).

The new guidelines proposed would give engagers the responsibility of deciding whether or not the contractors they use are IR35 compliant or not. They could be required to complete a new online tool, similar to the Employment Status Indicator (ESI) tool currently on HMRC’s website, to determine whether or not IR35 applies to them.

From our experience over the years of dealing with various clients and agencies, this could be problematic, both for the contractor and the engager themselves. Public sector bodies, and agencies who have not needed to care about IR35 in the past, would now need to take an active role in determining whether the Intermediaries Legislation applies to each contractor. It is likely that engagers will take the easy way out, and simply apply IR35 or stop using limited company contractors as part of their flexible workforce altogether. Contractors will also likely be deterred from taking contracts where IR35 is forced upon them.

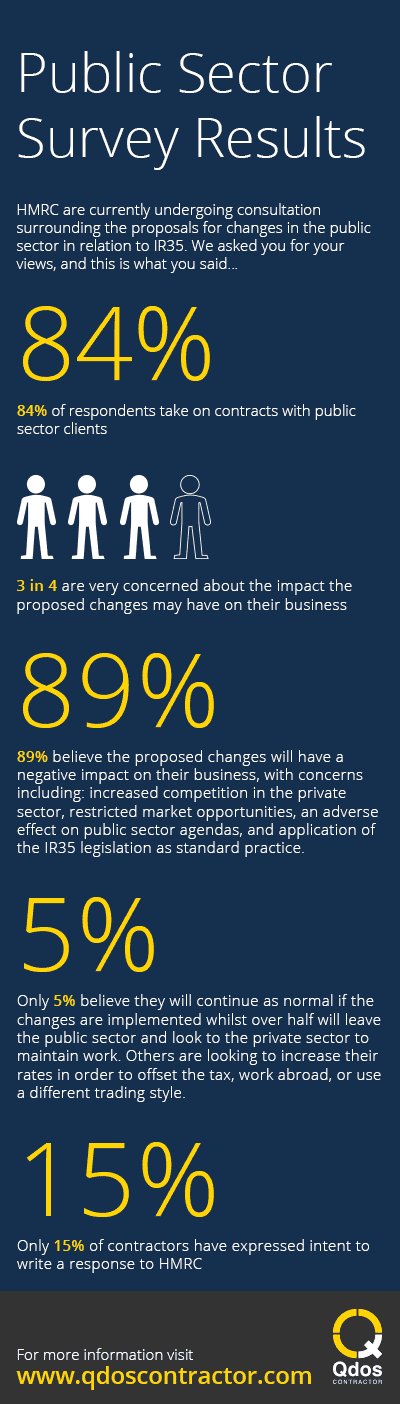

We conducted a survey to find out what the contracting industry thought about the new public sector guidelines…

It is clear to see that contractors are not pleased with the proposed changes; here are some of the comments we received in response to the question, “How do you think the proposed changes will impact your business?”

“Whilst I haven’t had public sector contracts (yet), this could saturate the private sector contract market increasing competition for the available roles. Additionally, the public sector would likely suffer.”

“Improperly force me to operate IR35, even though I can demonstrate that I’m properly operating outside IR35”

“Remove freedom to choose public clients, make working for public clients not profitable. I would be paying tax and NI but not get employees benefits”

“It is not clear yet. But once it is imposed on public sector, private sector will follow suit”

“I cannot see how anyone, but very large agencies such as Hays will be able to cope. This will utterly destroy the SME segment operating in the public sector.”

“Engagers will be much more cautious about offering contract work and are likely to engage inside ir35 by default…Public sector organisations are reactive by nature and contractors support these bodies to remain agile and responsive to policy changes and other organisational pressures – reducing access to such a flexible source of support and expertise will be damaging to public sector performance in the long run.”

“Risk averse public sector clients will default to “caught by IR35” – this would reduce our profit margin to unacceptable levels and we would no longer take on contracts with the public sector”

It is not just contractors that are concerned about the new guidelines, if this was to be implemented across the board, it could prove burdensome for engagers and agencies alike. We will not know which way it will go for sure until the Autumn Statement 2016.

Quite amazing really how the bully assumes the air of the wronged party in that it is their right to take more money off people without having earned a dime – let’s get this situation correct it’s not their money they didn’t earn it and frankly I fail to see why they should have any obviously the next revolution when it hopefully comes will be over tax – can’t wait for it to happen

If Contractors are required to pay tax and NI contributions as though they are on the clients payroll they should also be entitled to all employee benefits for the duration of their engagement. HMRC and public sector clients cannot have their cake and eat it.

Hi Mark,

Takes you back to 1776 and NO Taxation Without Representative. Time to tip HMRC’s tea into the pond.

I’ve heard that a government installation in the South West has had virtually all it’s Contract Testers say they will leave. Bet they won’t. Summed up by The Pretenders – Brass in Pocket. Followed by “My hometown” by The Boss.

Try it!

[quote name=”Helen”]If Contractors are required to pay tax and NI contributions as though they are on the clients payroll they should also be entitled to all employee benefits for the duration of their engagement. HMRC and public sector clients cannot have their cake and eat it.[/quote]

If public sector procurement (HR etc) is effectively indulging in disguised employment, then they should be sacked. Which if disguised employee = disguised employer would be quite just, as they have by definition now cost the state more money by giving a supplier permie benefits/rights on contractor rates.

Unfortunately if all those well paid managers hadn’t took early retirement with their gold plated salary based pensions and then decided to go back to work as very expensive contractors we wouldn’t be in this mess.

A greedy few have spoiled it for the hard working majority

I will be telling agents that I’ll only take contracts that are outside IR35. So the engager will have to sort out the working arrangements to satisfy themselves that HMRC won’t be asking for more tax at a later date.

Of course, the slippery agencies will say that the rate is ok even though it’s inside IR35 but that won’t be true. And once caught on one contract, all the work you’ve ever done is more likely to be seen as caught.

[quote name=”A”]I will be telling agents that I’ll only take contracts that are outside IR35. So the engager will have to sort out the working arrangements to satisfy themselves that HMRC won’t be asking for more tax at a later date.

Of course, the slippery agencies will say that the rate is ok even though it’s inside IR35 but that won’t be true. And once caught on one contract, all the work you’ve ever done is more likely to be seen as caught.[/quote]

Agencies are also a big part of the problem (the opacity they insert by being part of the pipeline between client and supplier) .

They only play two roles : locator of suppliers for a client + most commonly a “credit factor” for the supplier.

There should be a 3 party contract that is signed that states the work items, delivery dates, working methods (substitution is allowed etc) , payment terms, restraint periods between client and supplier, if the agency is open enough : their margin etc.

Anything NOT relating to the above can go in separate client/agency and agency/supplier contracts.

Correspondingly, the taxman by law should only judging on the 3 party contract. If the client + agency decide to get snidey in their contract and the effect is disguised employment, let both of them incur the tax/benefits costs.

[quote name=”A”]I will be telling agents that I’ll only take contracts that are outside IR35. So the engager will have to sort out the working arrangements to satisfy themselves that HMRC won’t be asking for more tax at a later date.

Of course, the slippery agencies will say that the rate is ok even though it’s inside IR35 but that won’t be true. And once caught on one contract, all the work you’ve ever done is more likely to be seen as caught.[/quote]

IMHO agencies are also a big part of the problem (the opacity they insert by being part of the pipeline between client and supplier) .

They only play two roles : locator of suppliers for a client + most commonly a “credit factor” for the supplier.

There should be a 3 party contract that is signed which states the work items, delivery dates, working methods (substitution is allowed etc) , payment terms, restraint periods between client and supplier, if the agency is open enough : their margin etc.

Anything NOT relating to the actual work can go in separate client/agency and agency/supplier contracts.

Correspondingly, the taxman by law should only judging on the 3 party contract. If the client + agency decide to get snidey in their contract and the effect is disguised employment, let both of them incur the tax/benefits costs.