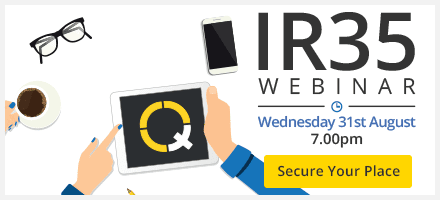

With 4 specialist IR35 teams committed to tackling 250 enquiries at any one time, IR35 experts Qdos Contractor, are holding a live event on 31st August to tackle the most common question when it comes to the IR35 legislation – how do I ensure I am operating compliantly?

Seb Maley tells us “[IR35] compliance is one thing in the eyes of the courts, and another in the eyes of HMRC; if HMRC conclude that you should have been applying IR35 you will have to either pay the demand or fight them in court, both of which are costly. It is therefore important for contractors to end enquiries as early as possible with a good defence.”

Rather than an overview of the legislation itself, this webinar will provide actionable insights for contractors to take away and implement, along with a Q&A session at the end and access to exclusive Qdos discounts for all attendees, whilst a recording will be provided to everyone who registers.

Qdos Contractor have been defending contractors against IR35 since it came into force, saving contractors over £35million in tax, and making them one of the UK’s leading authorities on the legislation.

hi, I am setting up as a subcontractor to the haulage business, I work through agencies and know I cannot claim subsistence and mileage as I am under direction at the place of work. I am also confused on how I am supposed to claim for my mobile phone bill. does it have to be in the company name or does my own name suffice? also, am I ok to write a petty cash receipt for the washing of my clothes? Also, how long , and how often must I swap agency’s, and is there a maximum cut off period as to how much I can use a agency per year, etc. any more info about his would be great help. thanks and look forward to your help.